Inspiring Families to Dream Again

Justin Hendren, Licensed Strategist

We work hand-in-hand with Global Financial Impact (GFI) to educate, encourage, and inspire - so you understand your options, feel confident in your plan, and move forward with clarity.

Lock in income so the mortgage, daycare, and essentials stay paid—no matter the plot twist

Rescue old 401(k)s and design tax-smart growth without direct stock market participation, guaranteeing safety of principle during market downturns

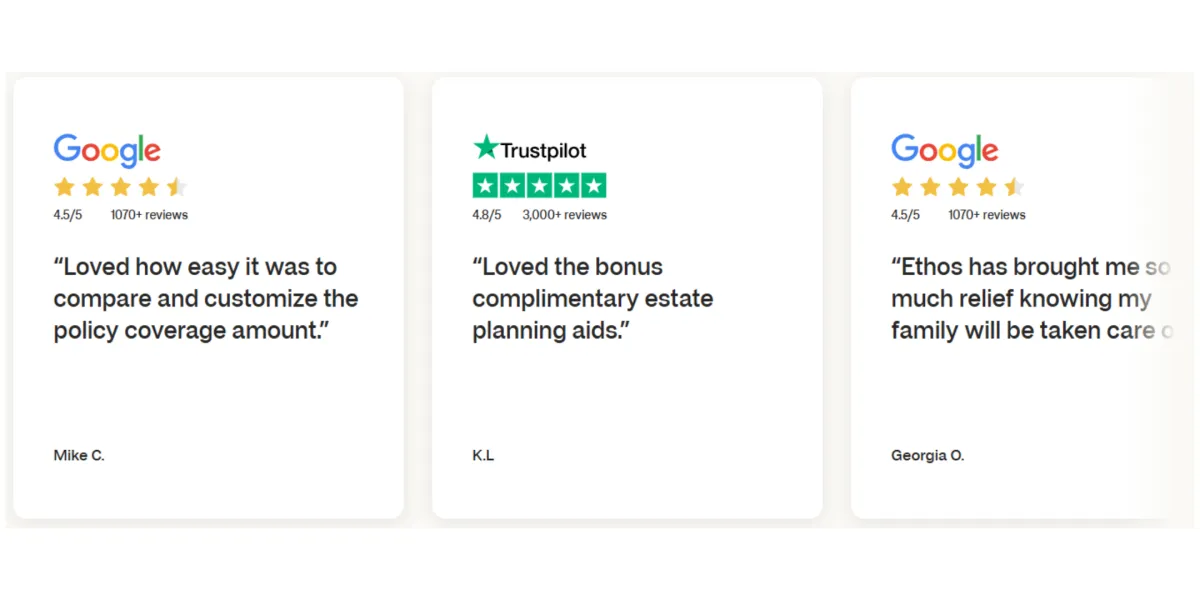

Keep your legacy simple with fast and instant approvals (not weeks) and even FREE wills and trusts.

Some of Our Solutions

Tax-Free Retirement

We help you build a retirement plan so you can take money out later with little or no income tax. The goal is to lower future taxes, reduce stress from market ups and downs, and create flexible income you won’t outlive—explained in clear, simple steps.

Market Loss & Asset Protection

We help guard your savings from big market drops so you don’t have to “start over” after a bad year. The aim is steady progress, less stress, and a clear plan you can stick with.

College Funds

We set up a simple plan to save for school without guessing. You’ll see how much to put away and how it can grow, so tuition doesn’t sneak up on you.

Family Banking/Infinite Banking Strategies

We show ways to use certain life insurance policies to build cash value you can access later for big goals. It’s about control and flexibility—used wisely, not as a get-rich shortcut.

Living Benefits

Some life insurance can let you access money while you’re alive if you face serious health events (if you qualify). That cash can help with medical bills and time off work when life gets tough. Riders vary by state and carrier.

Trusts, Wills, & Legacy Planning

We help you get organized so money and instructions go to the right people with less hassle. You’ll know what documents you likely need and how to keep your family out of chaos. We coordinate; not legal advice.

Business Owner Plans

We build protection and retirement strategies for self-employed people and small businesses. Think income protection, simple benefits, and smarter ways to save for the future.

Long-term Care

We plan for help you might need later in life—at home or in a facility—so costs don’t wipe out your savings. You’ll see plain options and what they cover. Benefits and availability vary.

Budgeting & Managing Expenses

We create a clean, realistic cash-flow plan so bills get paid, savings grow, and money stress drops. No guilt—just a system that works.

Retirement Rollovers

If you left a job, we show how to roll over your old 401(k)/IRA the right way and line it up with your goals. The focus is fewer surprises, clear choices, and keeping your money working. Taxes/penalties can apply if done incorrectly.

Term Insurance - Return of Premium

Term life protects your income for a set number of years. With ROP, you may get back the base premiums you paid if you keep the policy to the end of the term. Availability and rules vary.

© 2025 Top Tier Financial (“Top Tier Financial”). Top Tier Financial is an independently owned insurance agency and a partner of Global Financial Impact (GFI). Policies are issued by unaffiliated, nationally recognized carriers. Products and features may not be available in all states and are subject to underwriting, suitability, and approval. To help avoid requiring a medical exam, applications may include health and lifestyle questions; eligibility and exam requirements vary.

Top Tier Financial may provide estate-planning education or tools. These are separate from our insurance products and are not legal or tax advice. For legal documents or advice, consult a licensed attorney in your state.